Earning a good income is great, but if you’re not handling your finances wisely, it can disappear just as quickly as it comes in. Smart money management is the pillar of creating wealth that helps you harness the power of money and deploy it for your well being and growth.

In this blog, we have touched upon some of the best money management tips that talk about saving, spending intentionally and investing for the future to ensure financial security. So, get ready to make long term wealth and make your money work for you instead of the other way around!

What Is Money Management

Money management is the process of effectively handling your finances that includes budgeting, saving, investing, and spending wisely. When you learn how to manage money, it can ensure financial stability and growth for an individual, household or an organization.

To that end, you can use the personal finance apps and avail the services of financial advisors to make managing money as easy as it can be! Moreover, poor money management can lead to cycles of debt, frustration and financial stress.

10 Money Management Tips to Improve Your Finances

Managing your money doesn’t have to feel overwhelming. These money management tips will help you improve your financial well-bring in a seamless and strategic way:

1. Create a Monthly Budget & Stick to It

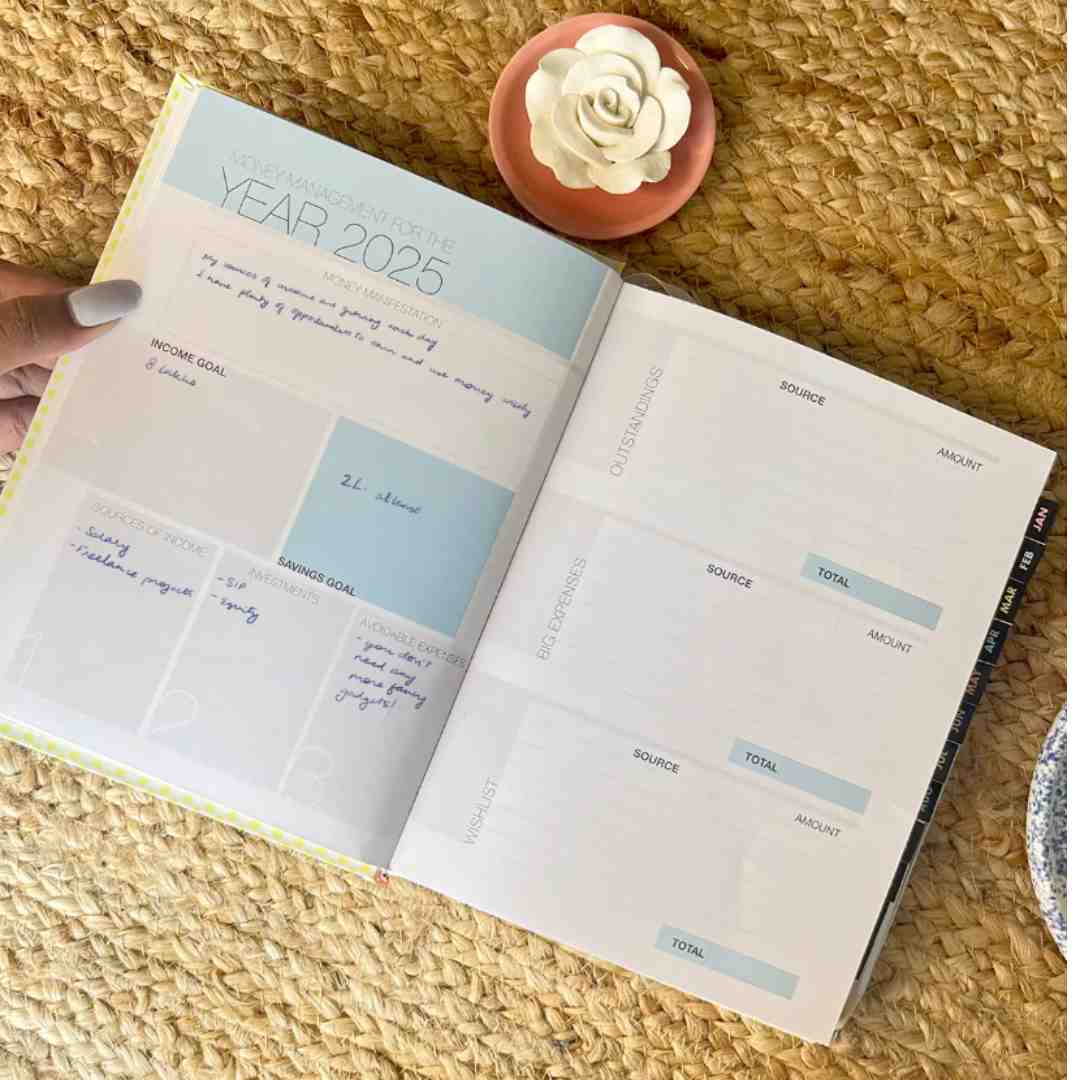

If you have ever felt that your salary disappears the moment you get it? These money management tips will come in handy for you. To manage your money well, you can start by listing your income and expenses and then appropriating your funds toward essential things, savings, and recreation or fun activities. This financial planning concept will work for you only when you follow it consistently.

2. Track Your Daily Expenses

If you are wondering about how to manage your money to the t, it is a good practice to track every expense (big or small) for at least a month. You can use an app, spreadsheet, or Zoomin’s finances planner. This will help you track the leaks in your budget and allow you to make smarter financial decisions.

3. Build an Emergency Fund

One of the fundamental goals of managing your money is to enable you to have money when you most need it! When it comes to life, mishaps, illness or unforeseen expenditures can strike at any time. An emergency fund acts as a financial safety net that keeps you from relying on debt when unexpected expenditures strikes.

4. Differentiate Between Needs & Wants

To nail your budgeting and money management, try segregating every purchase as a need or a want. From investing in a gadget to spending on some midnight meal, financial prowess comes down to making conscious spending choices. By differentiating between need and wants and prioritising necessities over impulse buys, you will be at a much better place financially.

5. Pay Off Debts Strategically

Debt, when not managed well can drag you down and how! To manage strategically, you can either pay off your smallest debts first or tackle debts with the highest interest rates first to save money in the long run. This is one of the best financial tips that can help you free up money for savings and investments.

6. Automate Savings & Bill Payments

You have got to treat savings like a non-negotiable bill to be religiously consistent with it. The same goes for bill payments. You can use technology and online banking to make automatic payments. This is a good way to stay on top of all your bills and keep your credit score in check.

7. Invest for the Future

Another cardinal rule of managing your money is to ensure that your money works for you and not the other way around. Smartly investing your money can essentially result in free money and more returns for your future.

8. Set Short-Term & Long-Term Financial Goals

What inspired you to figure out ‘how to manage your finances properly’? It could be saving for a vacation, buying a home, or retiring. When you set short-term and long-term goals, it helps you stay focused. Visualizing your goals can help you manifest them while keeping your finances on track.

9. Plan for Retirement Early

The sooner you start saving, the more you benefit from compound interest. Even small savings and investment can grow significantly over time. Also, retirement may seem too far but that’s not the case. Start early and your future self will thank you.

10. Review & Adjust Your Financial Plan Regularly

Your financial situation can change from time to time, and your budget should too. It is best to review your expenses, savings, and progress toward your goals so that you can make necessary adjustments wherever needed.

Final Thoughts on Money Management Tips

Judicious money management skills are not about being perfect with your money but about building smart habits that set you up for success.

Zoomin suggests that you start with small steps, stay consistent, and boost your financial confidence. No matter if you have just started on your financial planning journey or want to refine your money management skills, these are some of the best financial tips that will help you take control of your finances and build a more secure future.

Faqs on Best Financial Tips

How to improve money management?

You can start by creating a budget, tracking your expenses, and charting out clear financial goals. For this, you must prioritise saving, automate bill payments, and reduce unnecessary spending to help you stay in control of your finances.

What is the 50/30/20 rule for money management?

This budgeting method suggests allocating 50% of your income to essential needs, 30% to wants or recreation and 20% to savings and debt repayment.

What is the 70/20/10 rule money?

This rule divides your income into 70% for expenses, 20% for savings and investments, and 10% for debt repayment or charity.

What is the 80/20 rule in money management?

This manner of managing your money is also known as the Pareto Principle. It suggests that 80% of your financial success comes from 20% of your money habits. For that, you can start saving consistently and making smart investments for long-term financial security.